Traversing a synchronised economic slowdown

Pointing to heightened economic and political uncertainty, particularly in China and the United States, the IMF cut its 2019 global growth forecast by 0.3 per cent to 3 per cent, and its 2020 estimate by 0.2 per cent to 3.4 per cent.

Vanguard also expects global growth to continue to soften over the next 12 months, and sees the likelihood of a shallow recession occurring in the US in 2020 as being above 50 per cent, with the risk of a more severe recession a 10 per cent probability.

The IMF's forecast also came with a stark warning: that the world is in a "synchronised economic slowdown", with financial markets expecting interest rates to stay lower for longer than had been anticipated earlier in 2019.

Indeed, more cuts to official interest rates in the US, Australia and other countries are highly likely as central banks attempt to use monetary policy as a lever to kick start growth.

"Financial conditions have eased even more, helping contain downside risks and support the global economy in the near term," said a joint commentary by the IMF's director of monetary and capital markets, Tobias Adrian, and deputy director Fabio Natalucci.

"But loose financial conditions come at a cost: they encourage investors to take more chances in a quest for higher returns, so risks to financial stability and growth remain high in the medium term."

Risk and fixed income inflows

Macro-economic and policy events have been among the key drivers of markets instability for some time, although risk assets such as equities are continuing to trade at high valuation levels.

"These periods of time do come about and they tend to be a more difficult time to invest, because you need to stay engaged in the market to earn respectable returns," says Christopher Alwine, principal, head of credit, of Vanguard's global Fixed Income Group.

"But, in staying engaged in the market, it's also important to make sure the risk levels that you're positioning your portfolios in are consistent with the risks of an economic downturn, because those risks are elevated.

"To a retail investor, that really comes down to how much you have in stocks versus fixed income and cash."

Ongoing large inflows into listed and unlisted bonds funds, where investment returns over the past year have been very strong, are a strong indicator of the de-risking phenomenon that's been occurring, and continues to occur, globally.

In a weak macro-economic environment, pointing to low inflation, higher unemployment and lower growth, broad fixed income strategies should perform relatively well as a risk diversifier to more volatile equities.

Most importantly, when you have your worst periods of equity performance, you want to see fixed income perform well. Yet, that's not always the case.

Understanding interest rate risk

Investors do need to be aware that the fixed income asset class is not homogenous. Indeed, depending on the investment strategy being used, investors in fixed income can be exposed to market risks they may not have appreciated at the time of making their investment.

For example, interest rate risk or sensitivity (duration) can enhance returns when share markets perform poorly.

But a fixed income fund may not necessarily perform this way if a fund manager has structured a portfolio in a way where the fixed income investments made materially change the underlying nature of the fund.

"One of the biggest decisions that you can make in a fixed income portfolio is to make significant duration bets," says Vanguard senior manager, investment product management, Scott Cornfoot. "They are single decisions that can be quite volatile and surprise investors.

"What you don't want is to invest in a fixed income portfolio and, when equities go badly or markets get jittery ... to find that your manager has taken a big duration position (that is, has effectively gone underweight fixed interest) and your portfolio doesn't perform as you would expect."

This is why low-cost actively managed global credit funds that invest in high-quality investment grade bonds, and which have very tight duration constraints, are attracting investor demand.

In addition to the risk-free component generated from government bonds, these credit funds seek to generate additional performance by investing across investment grade bond markets and by seeking out opportunities to add value through specific security selection.

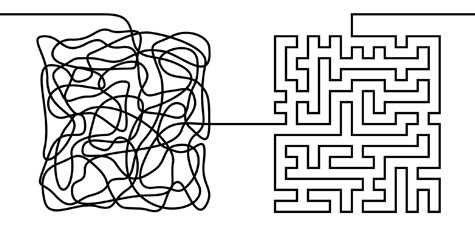

So, in a synchronised economic slowdown climate, if you're moving to de-risk your portfolio by shifting capital into fixed income, it's important to understand the nuances within the asset class and how they may impact returns.

This is where a licensed financial adviser should be able to provide guidance.

Tony Kaye

Personal Finance Writer,Vanguard Australia

29 October 2019

Vanguardinvestments.com.au